by David | Apr 25, 2023 | General |

by David | Dec 5, 2018 | General |

I have written elsewhere on this site about the frugality of buying a good quality, 2-3 year old used car and that a new car typically loses up to 40% of its value in just a few short years. You are literally taking a butt-kicking when you buy a new car. Oh, I know, I...

by David | Sep 27, 2018 | Debt, General, Retirement |

We mark anniversaries for different reasons: birthdays, holidays, weddings. Days when important and significant things happen. On this day eleven years ago, September 27, 2007, Christie and I attended a personal financial seminar given by Dave Ramsey in Houston, TX as...

by David | Aug 4, 2018 | Insurance |

Two days ago we had to say goodbye to a beloved pet. A 10-year old orange tabby named Julius Theodore, pictured here. Look at this nut! It is never easy to say goodbye to a beloved pet, but I’ve always believed they will tell us when it’s time. Maybe...

by David | Jul 26, 2018 | Retirement |

“The biggest selloff in stock market history” the article on CNN says. For months/years people have been buzzing about how you should own Google stock, Facebook stock, Amazon, and Netflix stock – it’s called the FANG profile. High tech, big...

by David | Jul 16, 2018 | Budgeting, Retirement |

In a recent MSN article basketball great Shaquille O’Neal describes what he learned from his father about the money he was making as an NBA superstar: in a nutshell, he said that it won’t last forever and his dad was on him to do a good job saving and investing it....

by David | Jul 9, 2018 | Debt |

This blog has talked a lot about different personal finance topics ranging from budgeting, saving for retirement, and paying off debt….except that up til now I haven’t described exactly how to pay off debt. How hard can it be? You just start paying extra on all your...

by David | Jun 27, 2018 | General |

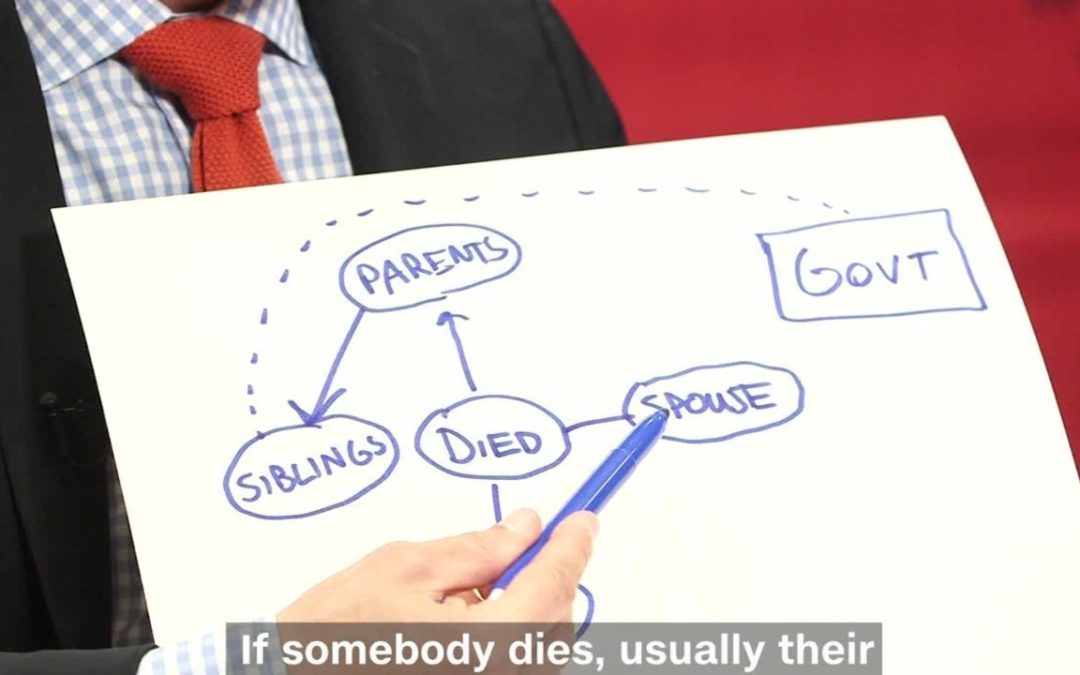

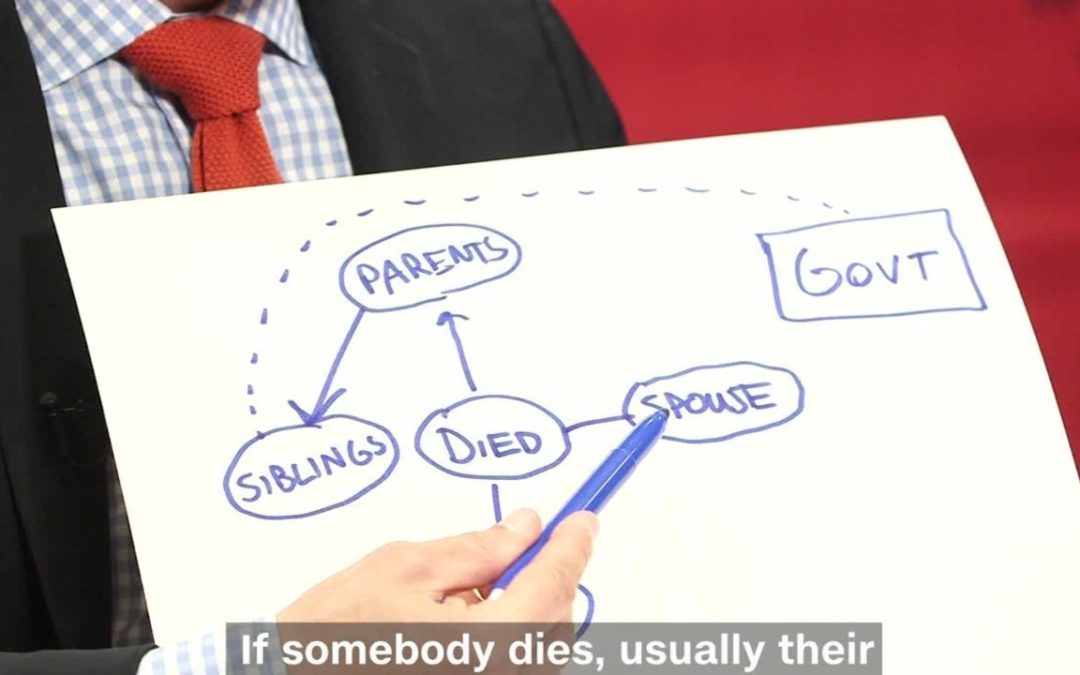

Do you have a will? No? Neither did multi-millionaire Prince, and what a mess that is turning out to be. But today’s post is not about Prince, and it isn’t specifically about money. It’s about some friends of ours that knew what to do. They knew they should have a...

by David | Jun 19, 2018 | Debt, Retirement |

Today, the stock market is in a free-fall. It’s likely a reaction to President Trump threatening new tariffs on Chinese goods yesterday. Certain individual stocks, and stocks in the specific industrial and materials sectors are poised to take the biggest hit. What...

by David | Jun 11, 2018 | Debt, Retirement |

I’ve been meaning to write about this for a while, when the Bitcoin rage was surging. Then I forgot about it, things cooled off, but now virtual currencies are back in the news again so I thought I would put these thought on paper….well, virtual paper, anyway. If you...

by David | Jun 4, 2018 | Budgeting, Retirement |

CNN Money reports that 56% of married women leave investment and long-term financial planning decisions to their husbands, and 85% of women who defer to their husbands believe their spouses know more about financial matters. It’s one thing to be the “nerd” in the...

by David | May 22, 2018 | General |

I could have titled this post “How To Do Anything”. The answer is, you have to find your “why”. Why do you want to save money? Most of us would honestly answer that one, “I dunno” or, “It’d be nice to have it in the...

by David | May 14, 2018 | Budgeting, Debt, Retirement |

We are casually shopping for new-to-us cars, about 2-3 years old. We are not at all in the market for new cars. Why, you might ask? Because on average a new car loses 42% of its value in the first three years.1 That’s literally turning $30,000 into $17,000 in three...

by David | May 10, 2018 | General |

My wife and I are casually shopping for new-to-us cars. Both of our cars run fine right now, though with some ailments that we’ve learned to live with. Like, her car’s radio amp doesn’t work and to replace it would be a costly undertaking as it was a “premium” sound...

by David | Apr 30, 2018 | General |

I wrote about Prince dying without a will in this post, and nearly two years after his death his estate is still in disarray with no end in sight. Prince was worth hundreds of millions of dollars but the only ones getting rich from his estate are lawyers. According to...

Recent Comments