This blog has talked a lot about different personal finance topics ranging from budgeting, saving for retirement, and paying off debt….except that up til now I haven’t described exactly how to pay off debt. How hard can it be? You just start paying extra on all your bills, right? Then poof, after a while you’re out of debt. Simple.

Well not exactly.

Getting out of debt takes time. It takes longer than you think it will. It’s like a home remodeling project…it takes twice as long as you think and costs twice as much as you budget for. That analogy isn’t perfect, but what I mean is that Life Happens while you are paying off debt and you won’t always be able to put as much on the debt as you plan to. Nonetheless, you just gotta plow through it. Here’s how.

- Stop Using Credit Cards What What WHAT??? “I get bonus points, free miles, and an oven mitt!” I’ve debunked those “perks” elsewhere. At least for the time that you are cleaning up your mess, stop using credit cards. Period. You are not the exception.

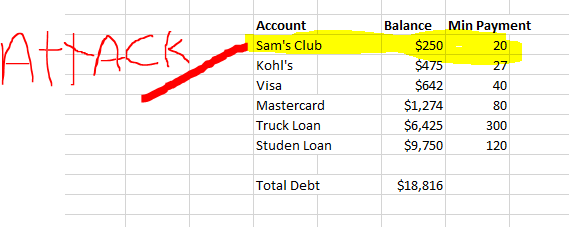

- List All Of Your Debts, Smallest To Largest Write down all of your debts except your mortgage, in the order of smallest balance to largest balance. A snippet of what that might look like is:

The interest rate doesn’t matter. We are going to attack this list of debts in the order of smallest balance to largest balance, and there’s a very good reason why. Because it works. Getting out of debt is not about the math of “pay off the highest interest rate first” because if we were any good at math, we wouldn’t have credit card debt. Yet here we are. Northwestern University proves that getting out of debt is about changing behavior. Just trust me, it’s science. LOL

The interest rate doesn’t matter. We are going to attack this list of debts in the order of smallest balance to largest balance, and there’s a very good reason why. Because it works. Getting out of debt is not about the math of “pay off the highest interest rate first” because if we were any good at math, we wouldn’t have credit card debt. Yet here we are. Northwestern University proves that getting out of debt is about changing behavior. Just trust me, it’s science. LOL - Attack The One With The Smallest Balance Once you have them written down, each month pay the minimum amount due on each account – except for the smallest. And ATTACK that smallest debt with as much as you possibly can. Squeeze everything you can out of your budget to pay as much as possible. Sell something. Hold a garage sale. Get MAD at your debt! In our example we have six debts. And the smallest debt is $250. Let’s say it takes two months to pay that balance to 0.

- Lather, Rinse, Repeat After two months, guess what? We don’t have six debts, we have five. The first one is GONE. Whoo hoo! The original minimum payment on the gone debt was $20. So you add that to the minimum payment of the next smallest debt ($27) and everything else we can scrounge in our budget, and we are able to pay $200 a month toward it (because we are still paying minimums on everything else). In two months and some change, that second debt (Kohl’s) is gone and we’re down to four debts. At this point you start to think, “Hey this can work!”

What you are doing is building the discipline that it takes to behave this way with money for the long haul. By the time you get to concentrating on the truck loan and especially the student loan, you will have built up this discipline. You know it will work, because look at how much you have already paid off? These last two are just going to take some time. This is exactly how Christie and I paid off $154,000 in non-mortgage debt. It took us longer than most, but we had more debt than most. It took 6.5 long, long years. But we did it. It works. And it will work for you, too. If you will decide to do it.

For more on the Debt Snowball, read The Total Money Makeover by Dave Ramsey, or take an FPU class.

Recent Comments