The headline of a recent article on student loans proclaims, “Student loan borrowers with high debts aren’t making progress repaying them”.

File this under, “Thank you, Captain Obvious. What was your first clue??”

Student loans are just one of many, many ways we as a nation and we as an older generation have failed our youth. To have pushed student loans as the de facto way of attending college does everyone involved such a disservice.

- The Student Fresh out of high school with a still-developing brain, we have saddled Junior with $40,000 – $80,000 (or more) of debt. Whether he gets a degree or not. Did you know that only 39% of entering Freshmen will graduate college in four years?*** Let that sink in. That statistic is so bad, that the Department of Education had to modify how it presented the data. They now put it this way: The six year graduation rate for a 4-year degree is 59%. Meaning, a little more than half of entering Freshmen will graduate with a Bachelor’s degree within six years of starting. SIX years, for a 4-year degree. This is across all college types, all ethnicities, male and female.

- The Parents In some cases Mom and/or Dad will bend over backwards and do whatever is necessary for little Sally to go away to school. Including, in some cases, letting Sally make all the decisions. We heard of one instance where a high school graduate wanted to go to a neighboring state school “to be different”, and that she “really liked the quad (student area)”. Mom and Dad allowed it, and they were stuck paying out-of-state rates for a state school – just in a different state! It was all paid for with a combination of debt, some of it the Parent Plus loans which means the parentals are on the hook for anything the student doesn’t pay.

- Society It’s wrong to have normalized student loan debt. It’s wrong to normalize taking more than four years to complete a Bachelor’s degree. It’s wrong to think that everyone has the right and deserves to go to college. It’s wrong that the cost of college has risen faster than inflation. It’s also wrong for the government to guarantee student loans with yours and my tax dollars.

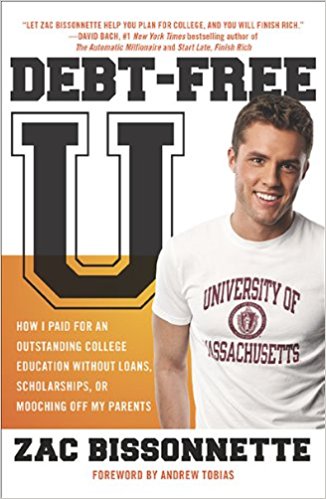

So, what can be done? For sure, read this book by Zac Bissonnette on graduating from college debt-free. It’s loaded with great ideas that Zac himself used to graduate debt-free from the University of Massachusetts.

Here are my favorite tips from the book to help minimize the financial impact of you or your child going to college:

- Choose an inexpensive in-state public university. I’ve looked at hundreds of resumes and interviewed dozens of folks over the years. Although a position may require that you have an appropriate college degree, I nor most anyone else involved with interviews and hiring really don’t care where you went to school. In a technology field, by the time you graduate the specific tools and topics studied may not even be used anymore. Having the degree in hand shows that you can complete something you started and that you have a base of knowledge in the field of study.

- Start by going to a community college. When I was in high school a bazillion years ago, no one wanted to go to the local community college. But a bunch of us should have. Your first year or two, the classes are all the same no matter where you go. Go local, live at home, and save a bunch of money in the process. You can transfer those credits to a state school for the last two years and graduate from that school.

- Work part time while in school and full time during the summers. It won’t kill you.

*** Sources: https://nces.ed.gov/ http://money.cnn.com/2017/08/02/pf/expenses-inflation/index.html

Recent Comments